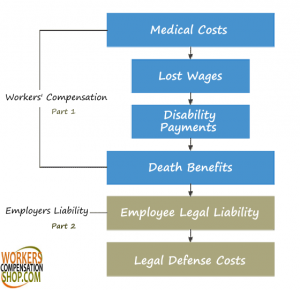

Workers’ Compensation Insurance comes in two parts, coverage A and coverage B. Coverage B is technically called Employers’ Liability Insurance, but the 2 types of insurance are often generically referred to as workers comp insurance in common usage. With respect to employees injured on the job, coverage A (Work Comp) provides unlimited coverage of all medical expenses, a set percentage of lost wages (which varies by state), a lump sum for disabling injuries as well as a disfigurement and death benefit. Business owners often confuse the coverage that part B limits. This effects workers comp benefits, but workers comp benefits are established by the individual state’s statutes. They generally cover all medical expenses when they are implicated. The limits on a policy only relate to employers’ liability claims.

Thus, it is important to know when employers’ liability limits could come into play. As written about in a previous blog entry, the most common types of employers’ liability claims are as follows:

(1) Third party claims: these claims are generally brought about by an injured employee against a manufacturer of the object causing the employee’s injury. The manufacturer then brings a claim against the employer for contributory negligence.

(2) Dual capacity claims: This is similar to the above, but it comes up when the employer is also a manufacturer. If an employee is injured by a defective product manufactured by his or her employer, he or she might bring a product liability claim against the employer in addition to claiming workers’ compensation benefits.

(3) Loss of consortium or other services to family members: loss of consortium and other claims such as modifications to homes or lost parental services resulting from a workplace injury can be covered.

(4) Consequential bodily injury: claims by the spouse or other family members of an injured employee arising from the injury such as a heart attack due to the stress of the news of the employee injury.

(5) Intentional acts/torts by the employer: claims covered in some jurisdictions such as knowingly allowing employees to work in unsafe workplace conditions.

Employers’ liability claims are rare. However, they can occur and are often costly when they occur. Employers’ liability coverage can cover damages/judgments, settlements, legal defense fees and other court costs. Increased employers’ liability limits generally only increase the cost of the workers’ compensation insurance policy by around 1%. Statutory minimum limits are usually (in all but a couple states) $100,000 bodily injury by accident (each accident), $500,000 bodily injury by disease (policy limit), and $100,000 bodily injury by disease (per each employee). These limits can also be increased to $500,000/$500,000/$500,000 or $1,000,000/$1,000,000/$1,000,000 in almost all cases as well as $2,000,000/$2,000,000/$2,000,000 is sometimes available.

Now that we have created a better understanding of why increased limits could come into play, what are the most common reasons for a business owner to need increased employers’ liability limits? The most common reason to get increased limits is probably that they are required by a contract important to a business owner. This is a common request, and it is the most common reason our agency sees for increased limits. However, there are several other good reasons to use higher than statutory minimum limits. To include a workers’ comp and employers’ liability policy under most umbrella policies, the limits generally need to be at least $500,000/$500,000/$500,000 and sometimes as high $1,000,000/$1,000,000/$1,000,000 limits. Another good reason to have increased limits is for businesses which are in industries that are more likely to have an employers’ liability claim arise. Such industries are generally higher risk industries which are more likely to experience devastating claims or manufacturing industries. Devastating claims are more likely to lead to loss of consortium or other services by family members type claims. Additionally, manufacturers are most likely to risk claims from disease exposures or dual capacity products liability type claims from employees. This should provide an understanding of when it is worthwhile to consider purchasing a slightly more expensive workers comp policy.